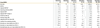

Second quarter October 2025 – December 2025

- Net sales decreased by 5 percent to MSEK 682.3 (721.7). Organic growth** was -4 percent.

- EBITDA amounted to MSEK 19.7 (9.5).

- Operating profit (EBIT) amounted to MSEK -9.9 (-14.9).

- Adjusted EBIT* amounted to MSEK -18.6 (-19.5), corresponding to an adjusted EBIT margin* of -2.7 percent (-2.7).

- Cash flow from operating activities amounted to MSEK 25.3 (17.2).

- Earnings per share amounted to SEK -0.17 (-0.45).

- Cash and cash equivalents amounted to MSEK 78.7 (119.1) as of 31 December 2025. As of 31 December 2025, the Group had unutilised credit facilities of MSEK 193.5 (178.4).

- Net debt excluding lease liabilities related to right-of-use assets amounted to MSEK 84.6 (54.9), representing an increase of MSEK 13.5 compared with 30 September 2025. Net debt (including IFRS 16) amounted to MSEK 375.5 (163.4), mainly due to the 20-year lease agreement, with an option for an additional 5 years, relating to Rail’s new production facility in Luleå, amounting to MSEK 179.0.

- During the quarter, the pension fund Chapelthorpe Pension Fund, which belonged to IFG’s UK unit, decided that the surplus of approximately GBP 3.4 million, net of tax, will be transferred to Duroc. The surplus has therefore been recognised in the Group’s other comprehensive income, as well as as a financial non-current asset with a corresponding deferred tax liability. The cash proceeds are expected to be received by Duroc within two years.

|

First six-month period July 2025 – December 2025

- Net sales decreased by 8 percent to MSEK 1,308.7 (1,426.1), where MSEK 164.5 is attributable to Asota. Organic growth** was -7 percent.

- EBITDA amounted to MSEK 25.2 (36.0), where MSEK -2.2 is attributable to Asota.

- Operating profit (EBIT) amounted to MSEK -30.1 (-12.2), where MSEK -8.4 is attributable to Asota.

- Adjusted EBIT* amounted to MSEK -37.5 (-16.0), corresponding to an adjusted EBIT margin* of -2.9 percent (-1.1).

- Cash flow from operating activities amounted to MSEK 52.4 (7.3).

- Earnings per share amounted to SEK -0.52 (-0.50).

- Equity amounted to MSEK 1,087.6 (1,143.2) at the end of the period and the equity ratio amounted to 53 percent (62). Excluding IFRS 16 effects, the equity ratio amounted to 62 percent (66). Equity per share attributable to the Parent Company’s shareholders amounted to SEK 27.0 (28.6).

- After the balance sheet date, Duroc entered into an agreement to divest all shares in IFG Asota GmbH, which will release significant capital and result in the Group being pro forma net debt-free (excluding lease liabilities under IFRS 16).

|